Patients are being asked to shoulder more and more of the costs for their health care, yet health insurance plans aren’t asking patients for input when developing specialty drug coverage policies, according to a study published this week in the Journal of Managed Care & Specialty Pharmacy.

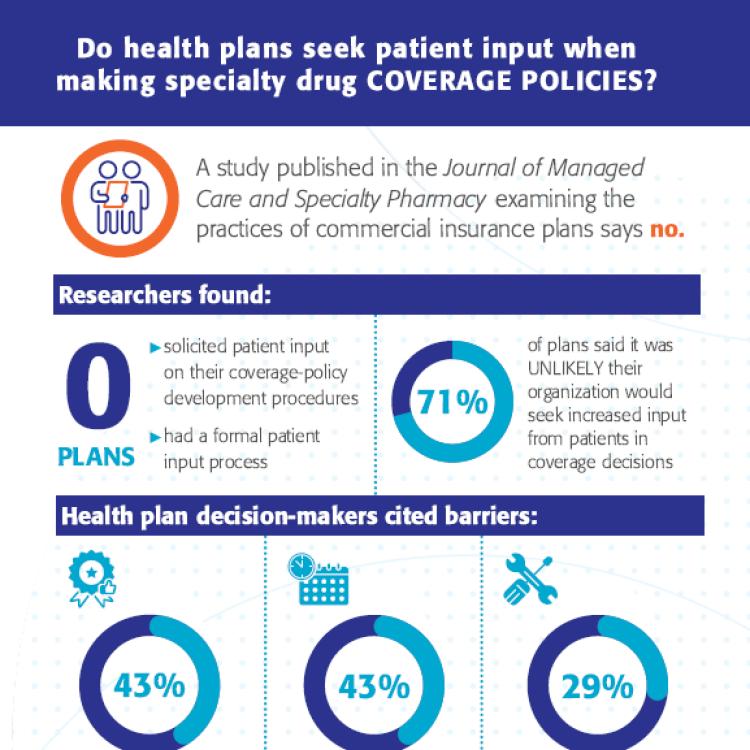

The study, written by researchers from the National Pharmaceutical Council and Tufts Medical Center's Center for the Evaluation of Value and Risk in Health, found that “[n]one of the health plans we studied reported having a formal process for including patient/member input into coverage policy development, and only a small proportion of the evidence cited in coverage policies included patient-reported outcomes or used a patient-based design.”

Our study points out that payers do not regularly incorporate the views of the patients they serve. This creates a barrier in patients’ efforts to gain access to the treatments or care they need.

NPC Chief Science Officer and Executive Vice President Robert Dubois, MD, PhD, said insurance plans must include the patient’s voice in their coverage policies.

“As we endeavor to move our health care system to be patient-centric, it is critical for payers to also incorporate patient input and perspectives,” said Dr. Dubois. “Our study points out that payers do not regularly incorporate the views of the patients they serve. This creates a barrier in patients’ efforts to gain access to the treatments or care they need.”

The study reviewed a data set of private health plans’ policy development processes, as well as coverage decisions for specialty drugs and examined whether the evidence cited in policies included patient-reported outcomes. Decision-makers also were surveyed. The researchers found that plans rarely regarded patient input to be influential.

“I found two things to be particularly surprising,” noted James D. Chambers, PhD, MPharm, Associate Professor, Center for the Evaluation of Value and Risk in Health at Tufts Medical Center, and a study author. “First, almost half of the plan decision-makers we surveyed reported having never engaged with patients when developing coverage policies. Second, the majority of survey respondents said they thought it improbable that patients’ influence on coverage policy development would grow in the future.”

Why is it important that health plans seek out and include patient input in their coverage decision policies? Dr. Dubois says it’s the only way that plans can truly help patients.

“Patients experience diseases in ways that payers may not foresee – the challenges they face both with the burden of that disease and the treatments they need to undergo,” he said. “Understanding what is important to them is critical for payers if they wish their policies to be helpful to those patients.”

This study shows that consumers seldom have a direct role in shaping their insurance coverage and that there is an informational disconnect between coverage plans and the patients they cover. Coverage decision policies should start with the patient in mind and include as much patient input and feedback as possible to make sure that the decisions sync up to patient feedback.

The only way plans can do that is to engage patients in a systematic and consistent way. However, this study shows that private plans do not have a systematic procedure to gather patient input. By not reaching out to patients and incorporating their input into coverage policies, insurance plans are more likely to fall short of helping those they are supposed to serve.

“Information on patients’ ‘lived experience’ is an important complement to the clinical and economic data plan officials typically rely on when developing coverage policies. Only by accounting for patients’ perspectives on their condition and their treatment preferences can plan decision-making become truly patient-centered,” said Dr. Chambers.

Read the full study on the JMCP website.